Pivot Point Trading

Price Action And Pivot Point Trading Complete Guide Pivot Point Trading

Increase Your Forex Profit By This Pivot Price Action Logic Rfxsignals

40 Best Pivot Point Indicator For Metatrader 4 Ideas Forex Trading Intraday Trading Forex

Intraday Pivot Points Vs Daily Pivot Points Virtual Forex Trading Paramonas Villas

Trading With Pivot Points Fxtrading Com International

Pivot Points Let S Trade Forex Like The Pros

Welcome to Pivot Point trading blog!.

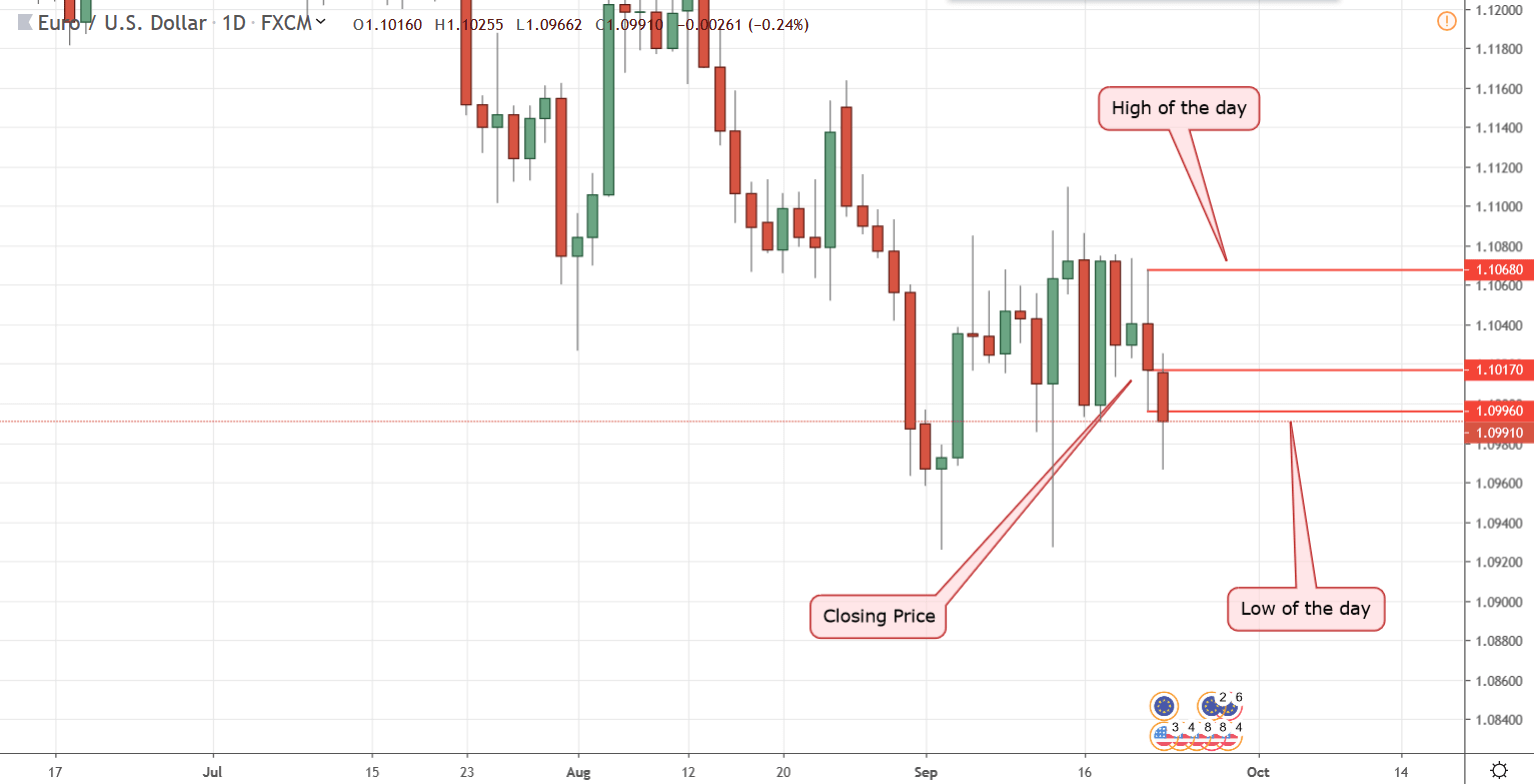

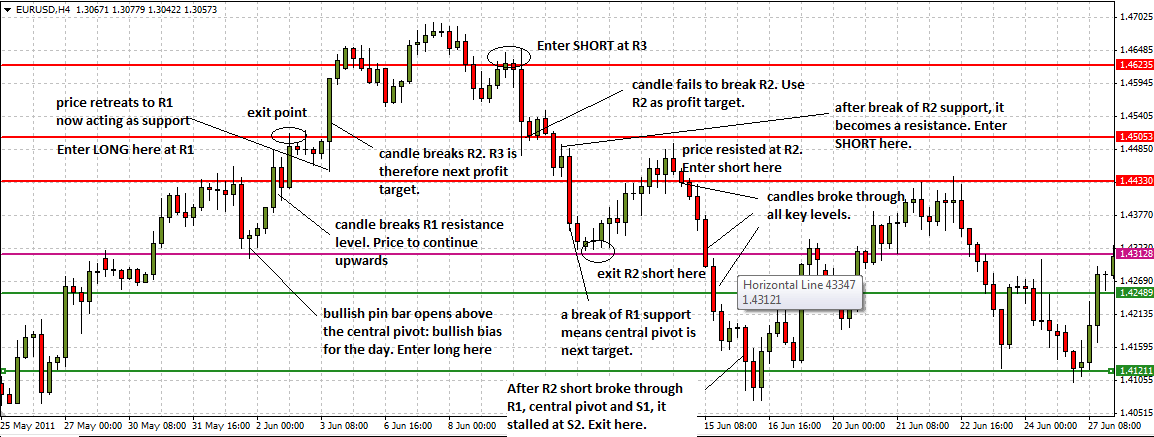

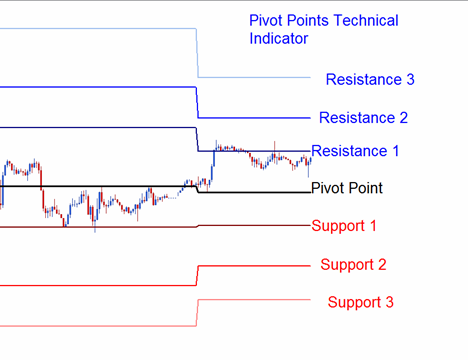

Pivot point trading. It is a technique developed by American traders back in the 80s It is based on data from the previous candle So if we are dealing with a daily pivot point, it is based on the data from the previous day, specifically on open;. Pivot points can be used in many types of trading and are one of the more popular tools in technical analysis of the market By understanding how to calculate pivot points and how they can help you in purchasing binary options, you will have yet another tool at your disposal to help you become profitable. The Pivot points First, a brief introduction of Pivot Points The subject is elaborate and you only need some basic understanding of pivotal points, because the main trading device will still be Fibonacci A pivot point is a group of horizontal lines to be calculated on the previous bars.

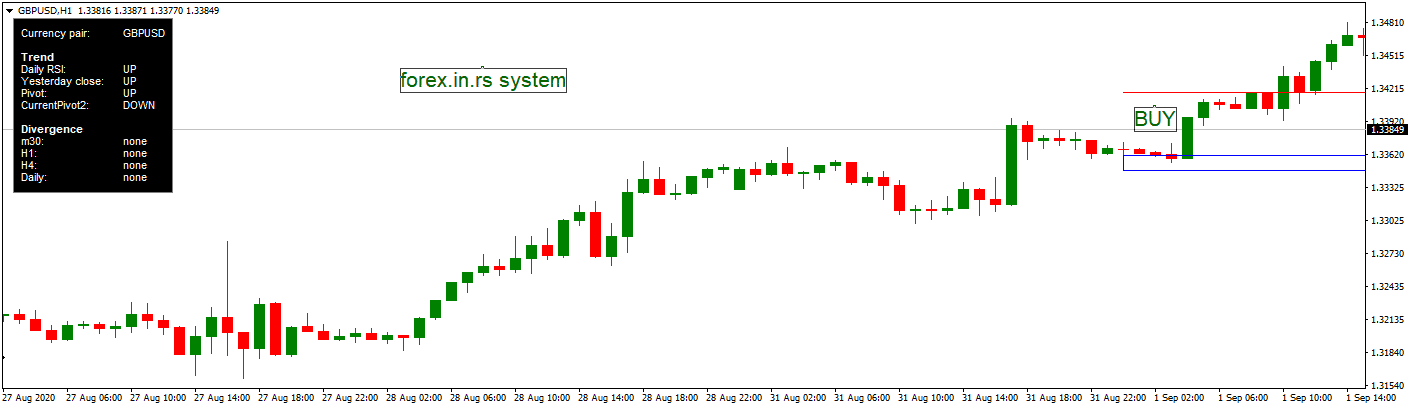

Pivot point trading strategies are an allinone approach to the market When used properly, the presence of a trend is easily determined, along with an individual trade’s entry and exit prices Applying a PP strategy to any futures market is relatively straightforward. It is a technique developed by American traders back in the 80s It is based on data from the previous candle So if we are dealing with a daily pivot point, it is based on the data from the previous day, specifically on open;. The site is dedicated to pivot point trading What is pivot point trading?.

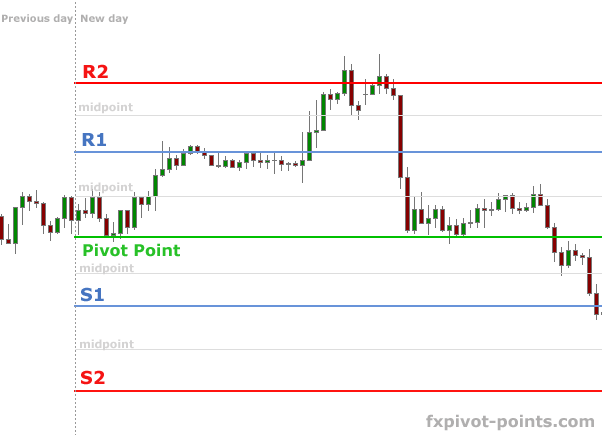

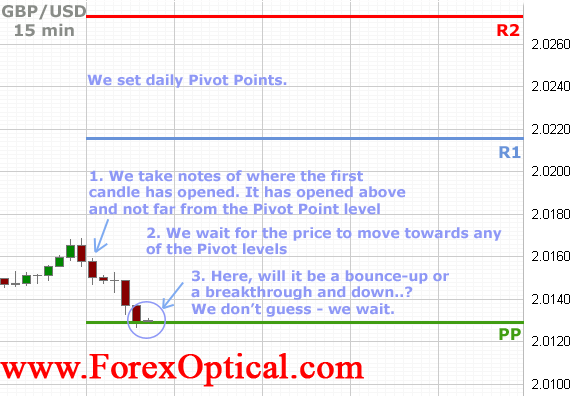

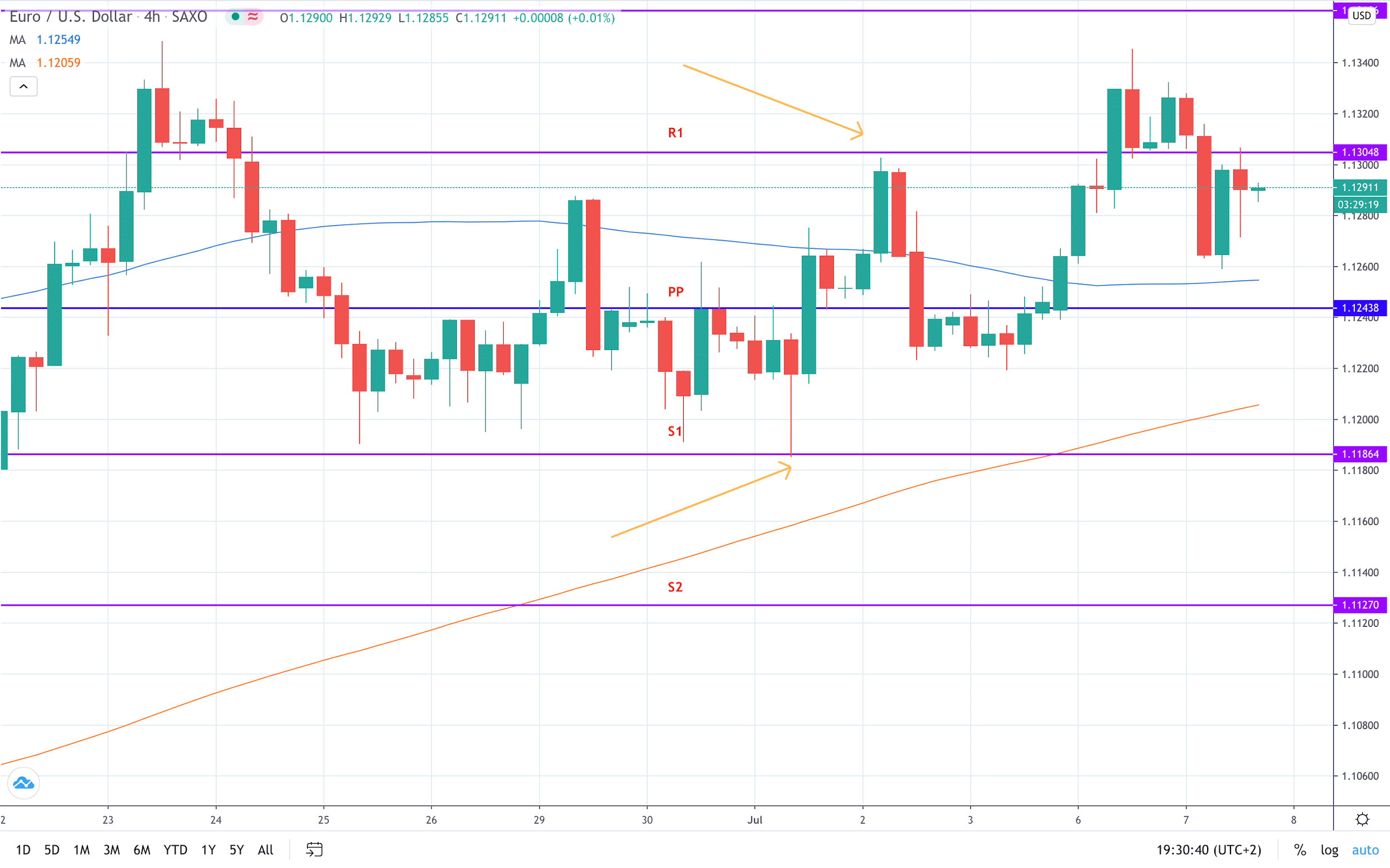

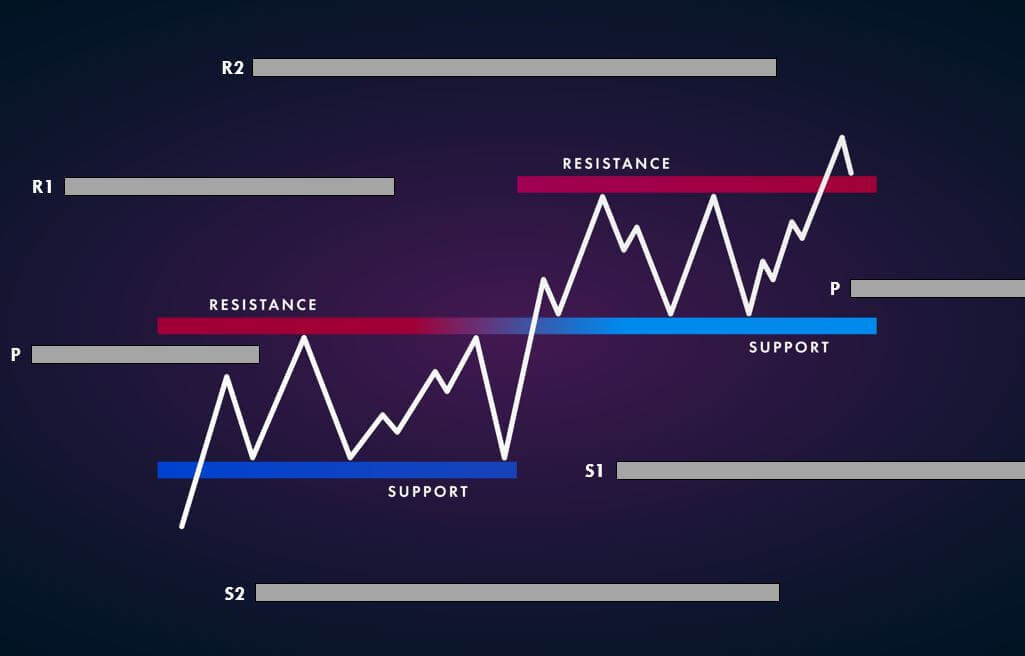

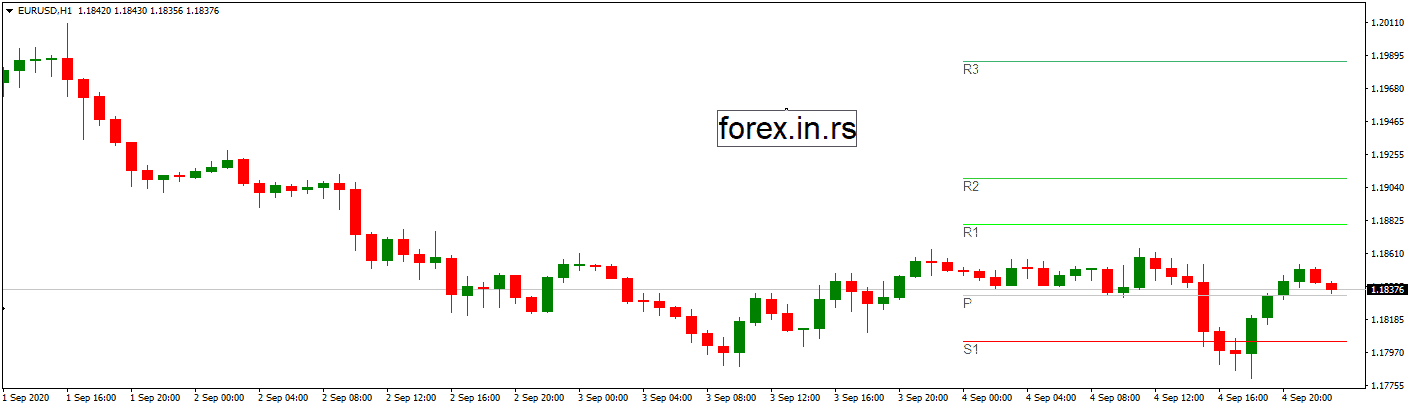

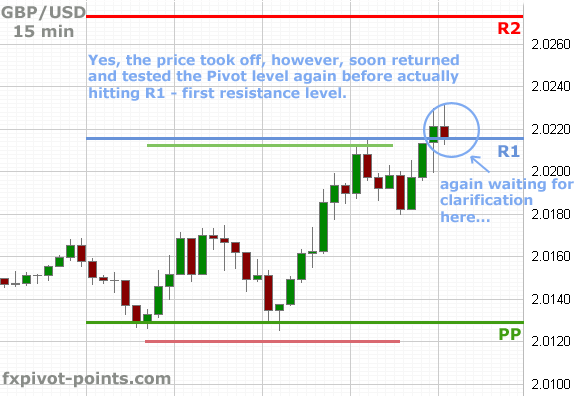

A pivot point is calculated as an average of significant prices (high, low, close) from the performance of a market in the prior trading period If the market in the following period trades above the pivot point it is usually evaluated as a bullish sentiment, whereas trading below the pivot point is seen as bearish. The simplest way to use pivot point levels in your forex trading is to use them just like your regular support and resistance levels Just like good ole support and resistance, the price will test the levels repeatedly The more times a currency pair touches a pivot level then reverses, the stronger the level is. If you are new to pivot point trading, especially forex pivot points, then we suggest that you start off by using the Classic formula set as these are the most popular type used in pivot point books to calculate pivot points If you are involved in online fx trading, option trading, fx options, online future trading or if you're trading oil.

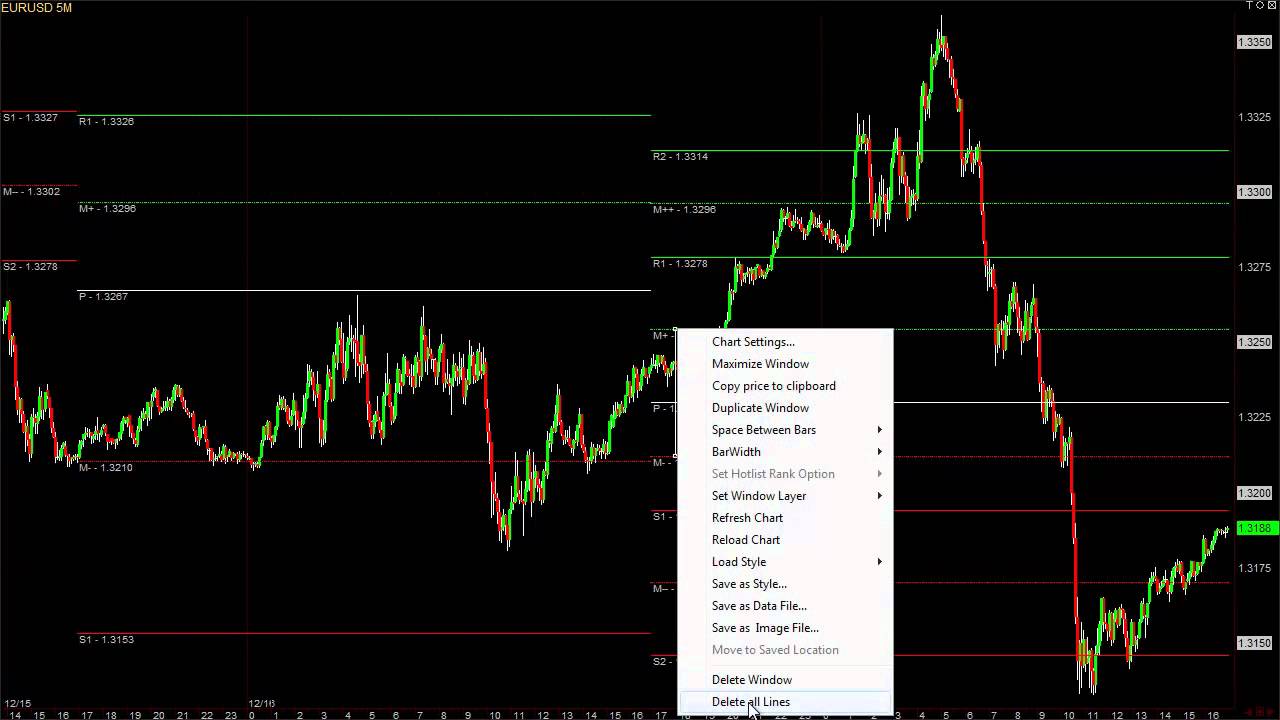

Again, those traders take a lot of data into consideration, but they would never overlook Pivot point analysis!. The site is dedicated to pivot point trading What is pivot point trading?. The pivot point indicator is an easy to use tool that’s been incorporated in most trading platforms The platforms automatically calculate support and resistance levels, so the trader doesn’t have to do it manually.

Private Coaching Sessions Schedule a Session Today. In trading stocks and other assets, pivot points are support and resistance levels that are calculated using the open, high, low, and close of the previous trading day The pivot point bounce is a trading strategy or system that uses short timeframes and the daily pivot points. The simplest way to use pivot point levels in your forex trading is to use them just like your regular support and resistance levels Just like good ole support and resistance, the price will test the levels repeatedly The more times a currency pair touches a pivot level then reverses, the stronger the level is.

Many Forex traders if not all successful ones do respect these important Pivot levels and heavily rely on them in making everyday trading decisions That's why we'd like to introduce Pivot points trading approach Pivot point trading. Pivot Point Trading You are going to love this lesson Using pivot points as a trading strategy has been around for a long time and was originally used by floor traders This was a nice simple way for floor traders to have some idea of where the market was heading during the course of the day with only a few simple calculations. Welcome to Pivot Point trading blog!.

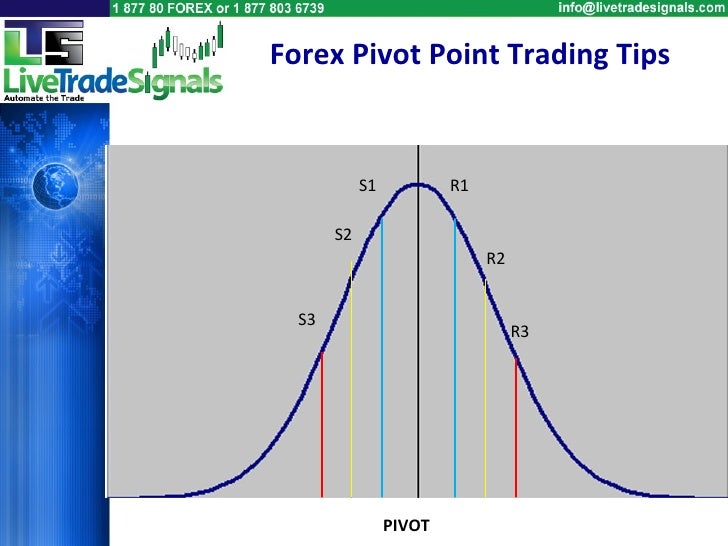

The Camarilla pivot trading strategy is a better way to use pivot points to improve your trading If you want to master pinpointing key intraday support and resistance levels, precision entry, and exit point the Camarilla trading strategy can help you achieve those goals This is your all in one guide to what is Camarilla pivot point. Whether you are trying to calculate the pivot points for the daily, weekly, or monthly timeframe, it follows the same method — you calculate the pivot point itself by using the high, low, and closing prices of the preceding trading session and use the value to calculate the corresponding support and resistance levels. Forex pivot points are identified in order to determine “interesting” levels These are marked by traders to note points where the market could change from “bullish” to “bearish” Hence, traders of financial markets use these points to identify support and resistance levels Types of Pivot Points Used in Forex Trading.

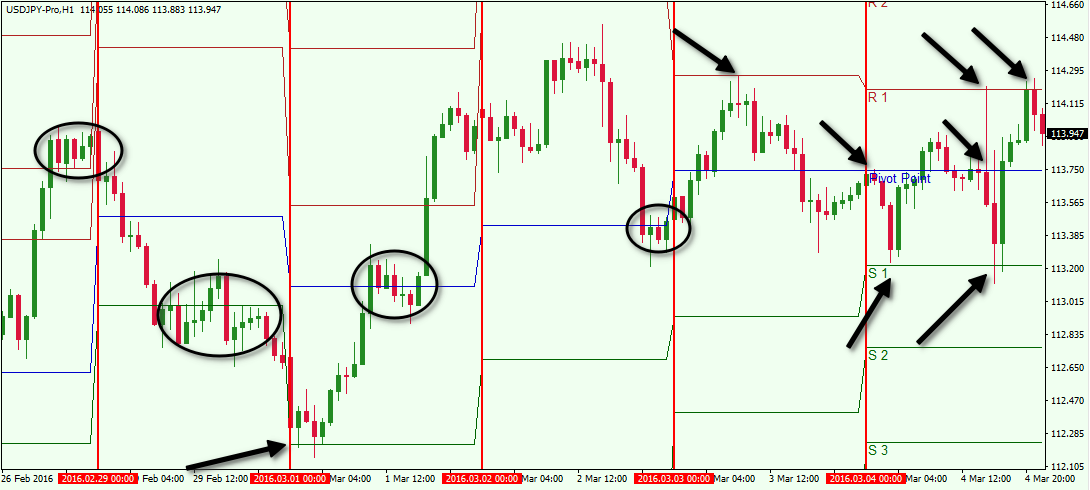

Just like your normal support and resistance levels, pivot point levels won’t hold forever Using pivot points for range trading will work, but not all the time In those times that these levels fail to hold, you should have some tools ready in your forex toolbox to take advantage of the situation!. Pivot Point Trading – Introduction Many professional daytraders utilize pivot point trading in their trade plans We like to use them each morning to identify who was in control during the overnight session During the US session, we like to use them as potential price targets and levels of support/resistance to qualify trades from. Pivot Point Trading You are going to love this lesson Using pivot points as a trading strategy has been around for a long time and was originally used by floor traders This was a nice simple way for floor traders to have some idea of where the market was heading during the course of the day with only a few simple calculations.

Pivot A pivot price is a price level established as being significant either because the market fails to penetrate it or because a sudden increase in volume accompanies a move through that price. The Pivot Points are calculated using the previous day’s high, low, and close and don’t change throughout the trading session The basic pivot point in the middle is the most important as it sets the level at which the market is equilibrium. Pivot Points are a popular indicator that many Forex traders will use in addition when price action trading But knowing how they work and how to use them.

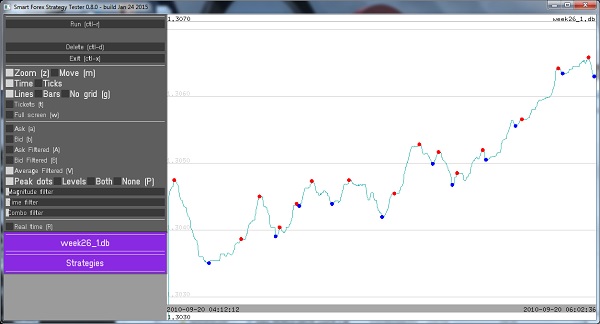

Pivot points represent the averages for the highs, the lows, and the closing prices that occur within a trading session or a trading day Pivot Points are a type of indicator used for technical analysis, which provides the basis for determining market trends Support & Resistance Levels in Pivot Point Trading. A Pivot Point Low, with a period of 5, requires a minimum of 5 bars before and after the Pivot Point Low to each have higher lows in order to be a valid Pivot Point How this indicator works The longer the trend (the higher the period selected) before and after the Pivot Point, the more significant the Pivot Point Pivot Points can be used to. Also pivot points are important information here, but the results will be determined by your trading plan By using pivot levels you can strongly increase the effectiveness of your strategy These levels are used by big players as well as by trading robots.

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment. Pivot Point Trading – Introduction Many professional daytraders utilize pivot point trading in their trade plans We like to use them each morning to identify who was in control during the overnight session During the US session, we like to use them as potential price targets and levels of support/resistance to qualify trades from. Pivot Point analysis is a technique of determining key levels that price may react to Pivot points tend to function as support or resistance and can be turning points This technique is commonly used by day traders, though the concepts are valid on various timeframes There are several methods of identifying the exact points.

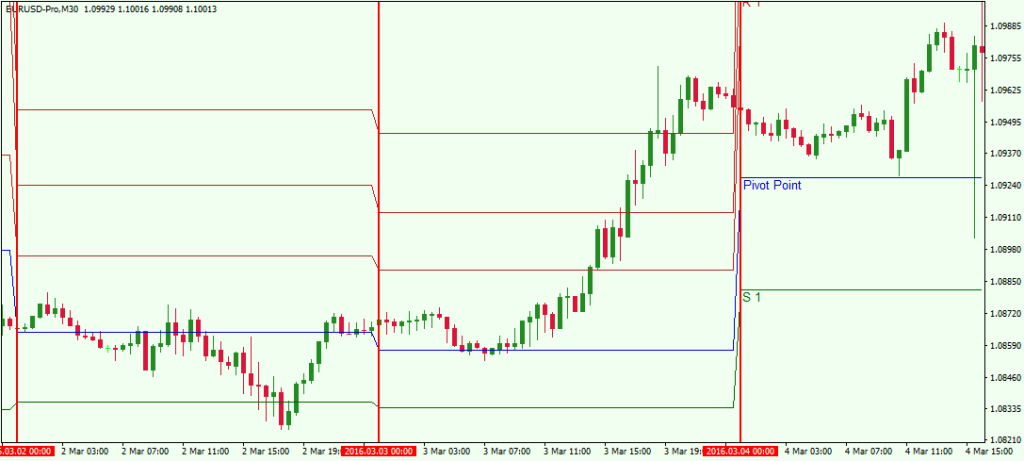

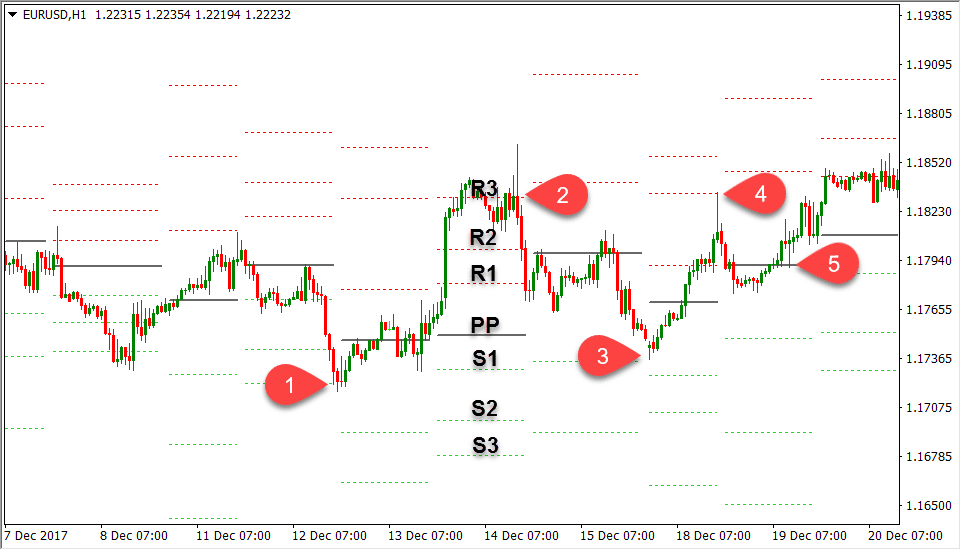

A pivot point is calculated as an average of significant prices (high, low, close) from the performance of a market in the prior trading period If the market in the following period trades above the pivot point it is usually evaluated as a bullish sentiment, whereas trading below the pivot point is seen as bearish. Pivot Points Standard — is a technical indicator that is used to determine the levels at which price may face support or resistance The Pivot Points indicator consists of a pivot point (PP) level and several support (S) and resistance (R) levels Calculation. Pivot Points were originally used by floor traders to set key levels Like modernera day traders, floor traders dealt in a very fast moving environment with a shortterm focus At the beginning of the trading day, floor traders would look at the previous day's high, low and close to calculate a Pivot Point for the current trading day.

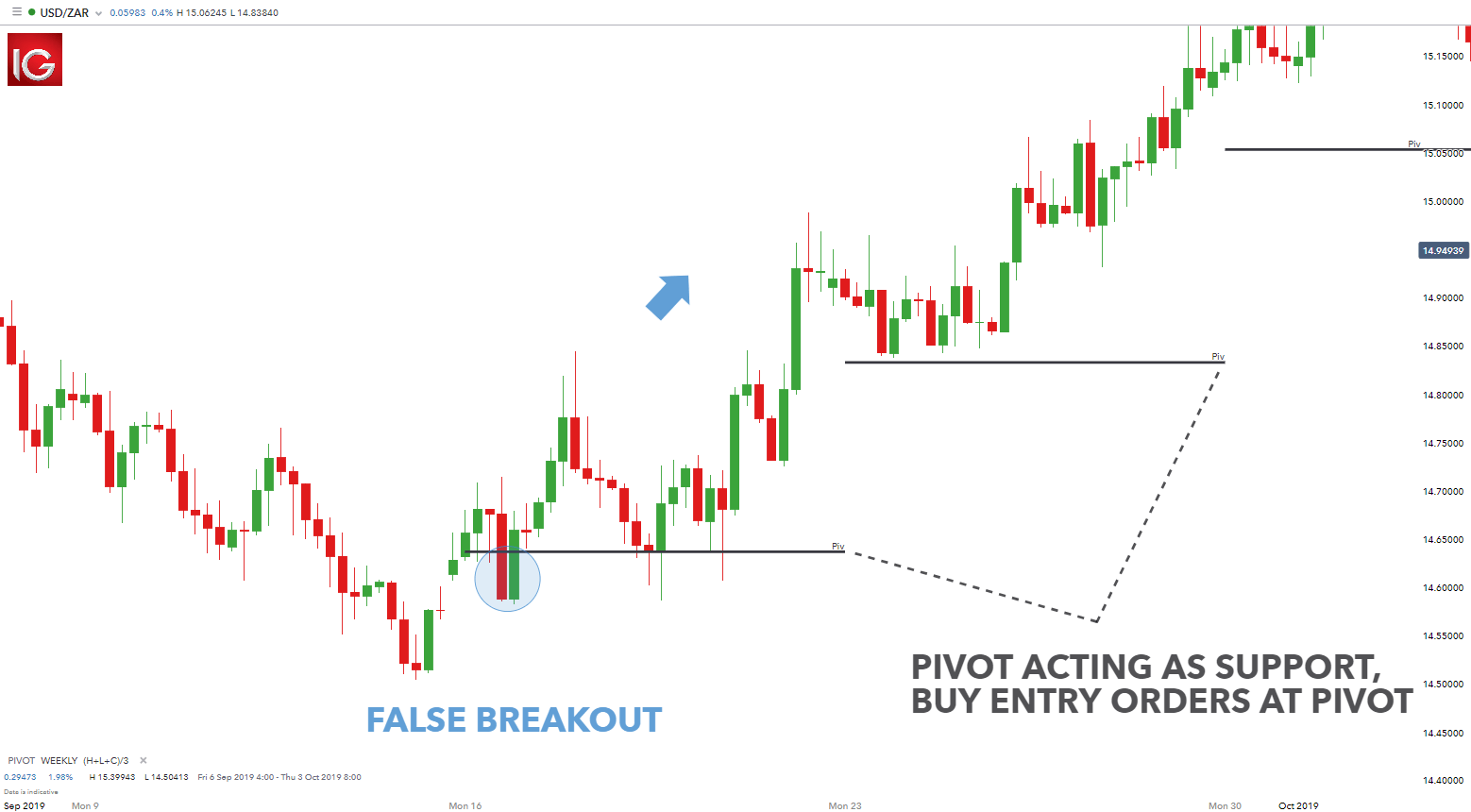

However, the pivot points Forex levels are static and don't change until the next period Whether you're trading Futures points vs ticks or Forex, you can use pivot points As a result, they work in any trading style Therefore, pivot points Forex translates to options and/or stocks 2 How to Calculate Pivot Point. Look for buying opportunities Wait for the prices to retrace to P Look for candlestick reversal patterns If P holds, go ahead and buy the stock with a target set at Resistance. A pivot point is a technical analysis indicator used to determine the overall trend of the market over different time frames The floor pivot points are the most basic and popular type of pivots The pivot points calculation for trading is more useful when you pick time frames that have the highest volume and most liquidity.

The pivot point trading rules described above are effectively price setups — a loose guide to price points that may be beneficial to trade A successful pivot point trading strategy will need to incorporate other skills like money management, exit strategies, judicious choice of market, etc. Pivot points are typically used for shortterm trading, however, there are pivot points that are used in monthly installments in the same way When calculating these, simply replace the maximum, the minimum, closing values of the previous sessions with one of the previous month It works the same way, any time frame. Pivot Point Intraday Trading Strategy Breakout This as the name suggests is a intraday trading system using pivot points Pivot Points are one of the more popular indicators when it comes to intraday trading In this post we will show you a totally mechanical system based approach to trade Pivot Points Just a point to note that, this system.

Pivot Point Trading Rules Opening above Pivot (P) If the stock opens above the Pivot Point (P) (or the Typical Price), it shows inherent strength in the instrument;. James is the Founder of Pivot Point Trading where he teaches online stock market classes for those looking to become active market participants He teaches w. The price is above Pivot but below R1 In this scenario, you should buy the stock/underlying above R1 (if the price reaches above R1) and sell below Pivot(if the price goes below Pivot).

Pivot Point Opening trading strategies It is essential to keep in mind one important thing when trading with Pivot Points the trading session opens in most cases near the central Pivot, even if this is not a fixed rule We consider this fundamental level as a natural point of attraction for prices. What are pivot points?. Pivot points have the advantage of being a leading indicator, meaning traders can use the indicator to gauge potential turning points in the market ahead of time They can either act as trade entry targets themselves by using them as support or resistance, or as levels for stoplosses and/or takeprofit levels.

Pivot point trading is also ideal for those who are involved in the forex trading industry Due to their high trading volume, forex price movements are often much more predictable than those in the stock market or other industries. Trading With Pivot Points Since pivot points are largely used to generate support and resistance lines, this system is traded much like any other support and resistance system You will want to open a long position when the price breaks above a calculated resistance or a short position when the price breaks below a calculated support. Using Pivot Points as a trading strategy has been around for a long time, originally used by floor traders It was an easy way for traders to have some idea of where the market was headed A Pivot Point is the level at which the market changes direction for the day.

How to Use Pivot Points for Trading As a pricebased tool, pivot points commonly serve two functions First to provide multiple price support and resistance levels (ahead of time) and secondly as a simple trend monitoring gauge The main pivot point (P in the formula) should theoretically get the most action when tested. The Pivot Points are calculated using the previous day’s high, low, and close and don’t change throughout the trading session The basic pivot point in the middle is the most important as it sets the level at which the market is equilibrium. Pivot points are an intraday indicator for trading futures, commodities, and stocks Unlike moving averages or oscillators , they are static and remain at the same prices throughout the day.

Of course, trading Pivot Points on their own is usually not robust enough and it is always advisable to layer additional confluence factors around such a trading approach But it is a great starting point for any trading strategy and as an alternative approach to common support/resistance tools. Need A Hand Beginning Your Career?. A pivot point is a technical analysis indicator used to determine the overall trend of the market over different time frames A pivot point is calculated based on the high, low, and closing prices of previous trading session/day and support and resistance levels that are projected based on the pivot point calculation as well as type of the.

Essentially, a Pivot Point is the average of the High, Low and Closing prices from a previous trading session Pivot Points act as a leading/predictive indicator in that on the subsequent day, trading that goes above the Pivot Point is considered a bullish signal, while trading that goes below it is considered a bearish signal. Pivot Point Intraday Trading Strategy Breakout This as the name suggests is a intraday trading system using pivot points Pivot Points are one of the more popular indicators when it comes to intraday trading In this post we will show you a totally mechanical system based approach to trade Pivot Points Just a point to note that, this system. Trading Woodies pivot points may be similar to other pivot point variations, however, understanding the subtle differences inherent to Woodies pivot points is key to developing a trading edge.

However, the pivot points Forex levels are static and don't change until the next period Whether you're trading Futures points vs ticks or Forex, you can use pivot points As a result, they work in any trading style Therefore, pivot points Forex translates to options and/or stocks 2 How to Calculate Pivot Point. Daily Pivot Point Trading Strategy Determine The Intraday Outlook The central pivot point is the most important part of the whole setup The location of the main pivot point on the chart represents an important information to be aware because there is a high probability that it will be reached. Private Coaching Sessions Schedule a Session Today.

Pivot point trading strategies are an allinone approach to the market When used properly, the presence of a trend is easily determined, along with an individual trade’s entry and exit prices Applying a PP strategy to any futures market is relatively straightforward. Pivot A pivot price is a price level established as being significant either because the market fails to penetrate it or because a sudden increase in volume accompanies a move through that price. One of the most widely used technical indicators in day trading, pivot points are a system of seven lines at different price levels that act as support and resistance levels.

Classic pivot point trading strategy This pivot point strategy is the most popular In fact, we have already mentioned it in the very beginning of this article But now we’ll get closer to the details Let us assume, that on November 25 price opened above the pivot point (green line) This means you should prefer buying.

Learn How To Day Trade Using Pivot Points

Pivot Points An Effective Trading Indicator Libertex Org

System Forex No Repaint How To Calculate Pivot Points In Day Trading Masterbec L Art Des Solutions Linguistiques Sur Mesures

Pivot Points For Risk Management

Intraday Pivot Points Vs Daily Pivot Points Virtual Forex Trading Paramonas Villas

3 Pivot Points The Best Forex Signals 19 No Repaint

Forex Chart Pattern Indicator Free Download Forex Robot Kullananlar

Universal Pivot Point Metatrader 4 Forex Indicator

How To Trade Binary Stocks Intraday Pivot Point Trading Xls Ls Fotografia De Bodas

:max_bytes(150000):strip_icc()/PivotPoint-5c549c1246e0fb000164d06d.png)

Pivot Point Charting Software Lewisburg District Umc

Stochastics Divergence And Pivot Line Strategy Investoo Com Trading School Brokers And Offers

Intraday Pivot Points Vs Daily Pivot Points Virtual Forex Trading Paramonas Villas

Fibonacci Ratio Based Pivot Point Support Resistance Strategy Forexmt4indicators Com

This Sp500 Chart Shows Why I Love Pivots Pivot Point Trading

Trading Using Pivot Points Forex Signals No Repaint Mt4 Indicators

Tiara Sands Condos 103 605 Forex Pivot Point Trading Strategy

Pivot Points Archives Fx Bee

Pivot Points Trading Strategy Forex Factory

Trade Breakouts With Pivot Points

Intraday Pivot Points Vs Daily Pivot Points Virtual Forex Trading Paramonas Villas

Dynamic Trend Trading With Classic Pivot Points

Pivot Points Calculation In Python For Day Trading By Gianluca Malato Towards Data Science

Active Trading Tips How To Use Pivot Points To Trade Trading Strategies 14 July 14 Traders Blogs

Pivot Strategies A Handy Tool For Forex Traders

Forex Factory Pivot Point Indicator Fx Trading 360t

Pivot Points Best Mt4 Ea Download Free Expert Advisor And Trading Robot For Metatrader

What Are Forex Pivot Points Learn Then Trade Fxscouts

Pivot Point Trading Masterclass Elearning Ace

Day Trading Strategy Building With Smart Forex Tester

Most Accurate Pivot Point Extra Indicator For Metatrader 4 Fx Trading Revolution Your Free Independent Forex Source

The Ultimate Pivot Points Strategy Guide Pro Trading School

Pivot Point Trading Learn How To Trade Pivot Points Like The Pros

Forex Pivot Point Calculation Pivot Point Trading Strategy Revealed

Best Pivot Point Trading Strategy Ellioet Wave Tradingview

Pivot Point Strategy An Easy And Very Effective Forex Trading Technique

Pivot Table The Most Important Trading Tool Day Trading Techniques Trading Systems Mql5 Programming Forum

Intraday Pivot Points Vs Daily Pivot Points Virtual Forex Trading Paramonas Villas

Trading With Pivot Points In Forex Market Immfx

Pivot Points To Catch Bottoms Reversal Trading And Pivot Points What You Should Know Pivot Point Trading

3 Profitable Pivot Point Strategies For Forex Traders Fx Day Job

Pivot Points Check In To My Trading System Artikel Wettbewerb Dukascopy Community

Q Tbn And9gcqxkxfgc3y8kiih2r7l4zen4sqxeqf1d2xik6h6eecnz8vrwbbw Usqp Cau

Forex Pivot Point Trading Daily Pivots Youtube

Pivot Points An Effective Trading Indicator Libertex Org

1

Forex Trading Tutorial Trading Forex With Pivot Points

Candlestick And Pivot Point Trading Triggers Setups For Stock Forex And Futures Markets Website 2nd Edition Wiley

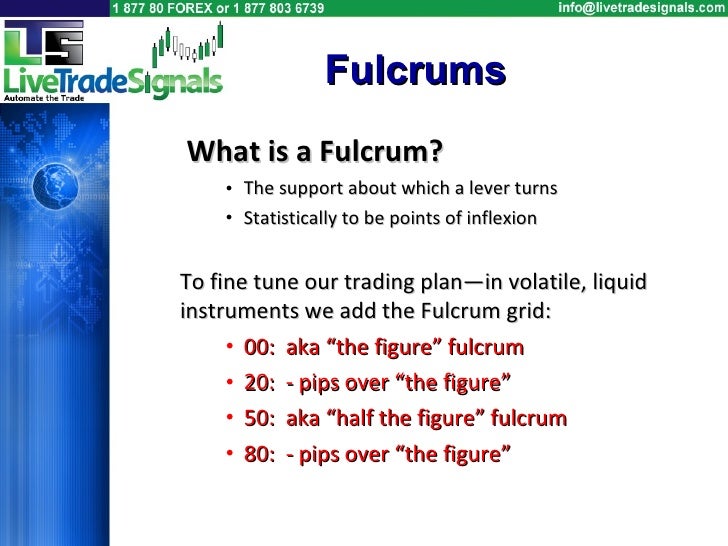

Forex Fulcrums And Pivot Points Trading Tips

Best Pivot Point Trading Strategy

Pivot Table The Most Important Trading Tool Day Trading Techniques Trading Systems Mql5 Programming Forum

Pivot Point Reversal Strategy Forex Education

Tradingview Dynobars Pivot Point Trading Strategy Forex Free Modern Man

Pivot Points Trading Meaning Indicator Strategy Screener Charts

Trading The Weekly Pivot By Price Action Article Contest Dukascopy Community

Pivot Points Trading Strategy Forex Visit Market Analysis Signals And Financial News

Pivot Point Trading Gbp Nzd Forex And Profits Community

How To Trade Pivot Points Trade Forex With Pivot Points

Pivot Point Reversal Trading System

Forex Pivot Points

Pivot Point Trading By Mark Mc Rae To Be A Better Trader

How To Trade Pivot Points Indicator Indicator And How Does It Work Trading Systems 14 May 15 Traders Blogs

Forex Fulcrums And Pivot Points Trading Tips

Pivot Points And Sdx Tzpivots Indicator In Forex Trading

How To Use Pivot Points To Trade Breakouts Fx Bee

Trading 60 Minute Charts Pivot Point Stock Trading Strategy Original Herbs

Pivot Points Trading Strategy An Almost Live Update Forex Useful

Pivot Point Indicator For Mt4 Forex Mt4 Ea

Pivot Point Strategy An Easy And Very Effective Forex Trading Technique

40 Best Pivot Point Indicator For Metatrader 4 Ideas Forex Trading Intraday Trading Forex

Pivot Point Bounce Trading Strategy Forex Education

Pivot Point Trading Strategy How To Trade With Pivot Points

How To Trade With Pivot Points The Right Way

What Is The Pivot Point And How You Can Download My Package On Your Python Editor To Compute It Fastly By Papa Moryba Kouate Analytics Vidhya Medium

96 Trading Breakouts Using Pivot Points Forex Academy

Pivot Point Strategies For Forex Traders Dailyfx

Pivot Points Trading Tips

Q Tbn And9gct6of0 Olbcvwzxrrezspxj3ty4uvzws5bzwnltpjqiquqf2fq1 Usqp Cau

Pivot Point Technical Analysis Binary Options Loss Formula Trenuj Jakbys Walczyl

What Is Pivot Point Trading Forex Education

Binary Options Charts Best Binary Options Trading Charts

Pivot Points Trading Tips

The Pivot Point Bounce Trading Method Fx Day Job

All Pivot Points Indicator For Mt4 Forexmt4indicators Com

Guide To Pivot Points One Of Tv S Greatest Free Tools For Coinbase Btcusd By Euromotif Tradingview

Guide To Pivot Points One Of Tv S Greatest Free Tools For Coinbase Btcusd By Euromotif Tradingview

Q Tbn And9gcqhz4wrdi7yhznh2k3fw72tdi6mh2j35qfbe64nqysjdrayhj Usqp Cau

Pivot Points Forex Trading Strategy Trade Pivot Lines The Secret Mindset

Pivot Points In Forex Trading Fx Trading Revolution Your Free Independent Forex Source

Pivot Point Trading Strategy How To Trade With Pivot Points

How To Apply Pivot Points Effectively When Trading Forex Forex Training Group

Forex Pivot Points Book Series Of Free Forex Ebooks Pivot Points Strategy

Trading With Pivot Points Fxtrading Com International

How To Trade With Pivot Points The Right Way

Pivot Point Best Forex Trading Center

How To Trade Using Pivot Points Ig Bank Switzerland

How To Use Pivot Points Trading Strategies Mt4 Indicator Fxssi Forex Sentiment Board

How To Set Pivot Points For Day Traders Bullbull

Pivot Point Trading Strategy With Pivot Point Indicator Trade Pips